When serious capital lines up for a single asset, markets pay attention. That is exactly what is happening with Royal Challengers Bengaluru.

Multiple non-binding bids have been submitted for Royal Challengers Sports Pvt Ltd, the holding company that owns RCB’s men’s IPL team and its women’s team. The seller, Diageo via United Spirits, is exiting a non-core asset, with the process expected to conclude by March 2026.

Valuations being discussed hover close to $2 billion, even though buyers appear more conservative at the early stage. Regardless of where the final number settles, one thing is clear. RCB has become one of the most hotly pursued sports assets in India.

The Buyer Line-Up Signals Serious Conviction

What makes the RCB bidding process notable is not just the price being discussed, but who is willing to engage at those levels.

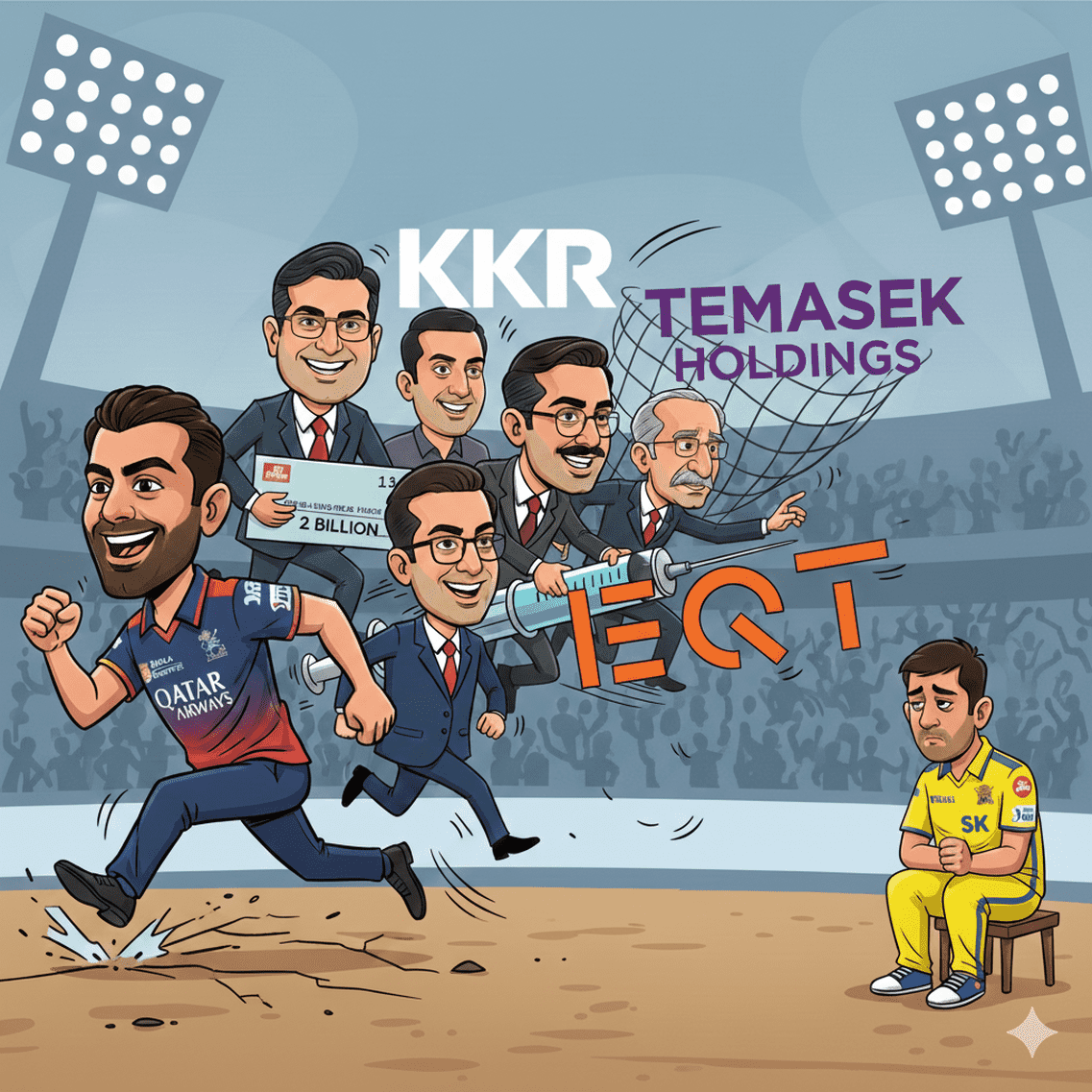

More than 50 non-disclosure agreements have reportedly been signed, pointing to deep institutional interest. Dr Ranjan Pai of the Manipal Group has entered advanced discussions to form a consortium with KKR, one of the world’s most experienced investors in sports, media, and consumer platforms. Temasek has also explored participation.

In parallel, Adar Poonawalla, EQT, and Premji Invest have submitted non-binding bids. The process itself is being run by Citi, reinforcing that this is a globally benchmarked transaction.

This calibre of buyers does not chase weak assets. Their presence confirms that IPL franchises, particularly top brands, now sit firmly on the radar of long-term capital.

Why RCB Commands So Much Attention

RCB’s appeal is obvious. It ranks at the top of IPL brand tables, dominates digital engagement, and commands one of the most passionate fan bases in world cricket. The recent trophy win has added momentum, and the presence of a women’s team aligns RCB with the evolving structure of cricket monetisation.

From an investor’s standpoint, RCB offers scale, visibility, and optionality across content, sponsorships, and licensing. It is easy to see why capital is willing to explore premium valuations.

But markets are not built on attention alone. They are built on outcomes.

Now Look at What the Numbers Say

RCB generates roughly ₹186 crore of EBITDA.

Now place that next to Chennai Super Kings.

CSK generates approximately ₹252 crore of EBITDA, nearly 35 percent higher than RCB. Yet CSK’s implied valuation sits close to $1 billion, roughly half of what RCB is being pursued at.

Same league. Same central media and sponsorship pool. Higher operating profit. Lower valuation.

This is where the valuation debate becomes unavoidable.

Trophies, Track Record, and Business Risk

RCB has lifted the IPL trophy once.

CSK has lifted it five times.

Beyond trophies, CSK has delivered consistency at a level no other franchise has matched. Regular playoff appearances, predictable performance, sponsor confidence, and disciplined execution have defined CSK for more than a decade.

From a risk-adjusted perspective, CSK behaves less like a volatile sports brand and more like a well-run consumer business. That distinction matters when capital is deployed for the long term.

Brand Premium Versus Business Quality

RCB is being valued primarily on brand intensity and future optionality. CSK, in contrast, is being valued conservatively despite what it already delivers.

Ironically, brand valuation studies consistently place CSK among the strongest IPL brands, often not far behind RCB. CSK also enjoys deep regional loyalty, high advertiser trust, and a reputation for operational discipline.

The difference is not brand strength. It is how the market chooses to price certainty versus excitement.

Markets have a long history of paying extra for noise and underpricing reliability. The IPL is now reflecting the same behaviour.

Women’s Cricket and the Long View

While attention remains fixed on RCB’s sale process, CSK is quietly reinforcing the same structural growth pillar that investors are rewarding across the league.

As discussed earlier on Unlisted Nivesh, CSK’s CEO has publicly outlined the franchise’s intent to enter the Women’s Premier League ecosystem as part of its next phase of growth. This approach is consistent with CSK’s long-standing strategy of entering new segments only when the commercial structure is clear and execution risk is lower.

A women’s team would allow CSK to deepen sponsorship inventory, expand content output, and increase year-round fan engagement using largely the same infrastructure. Incremental revenues would scale faster than incremental costs, strengthening long-term earnings visibility.

So Who Looks Better Priced Today

If sophisticated global capital is comfortable exploring RCB near $2 billion, despite lower EBITDA and a shorter history of on-field dominance, then CSK at $1 billion looks less like a conservative valuation and more like a mispricing.

Higher EBITDA. More trophies. Greater consistency. Comparable brand strength. A management-articulated growth roadmap. Proven operational discipline.

For investors who prefer buying quality before it becomes fashionable, CSK quietly offers more than the valuation currently reflects.

The Investor Takeaway

The RCB bidding war confirms that IPL franchises have arrived as a serious asset class. It also reminds us that capital often chases what is visible before recognising what is durable.

RCB may end up owned by elite investors, and rightly so. But that does not automatically make it the best-priced asset in the room.

History suggests that the most rewarding investments are often found not at the centre of attention, but just outside it. In today’s IPL landscape, CSK sits firmly in that space.